In 20, it extended close to $20 billion of these loans in San Francisco, Los Angeles, and New York alone, per Bloomberg's analysis. In particular, First Republic would offer interest-only mortgages, where the borrower didn't have to pay back any principal for the first decade of the loan. One of the causes of First Republic's troubles is a strategy to woo rich clients with huge mortgages that offer sweet terms, as detailed in this story from Noah Buhayar, Jennifer Surane, Max Reyes, and Ann Choi at Bloomberg. And like SVB, First Republic has been sitting on large unrealized losses, as the value of the bonds it's marked as being held-to-maturity has dropped as rates have gone up.īut while the FDIC seized SVB and Signature, a group of major banks parked $30 billion in deposits with First Republic, helping to shore it up in a period of where depositors opted to move their money to the biggest banks. Like SVB, First Republic had seen deposits boom in the low-rate pandemic era.

Like SVB and Signature, a large percentage of First Republic deposits were not insured by the FDIC, making it especially susceptible to deposit flight. Her parents have divorced, she has recently gone through a break up with a toxic ex, and her friendship dynamics seem to be shifting from what they usually are. She has absolutely no reason in her life to romanticize what you see in your tyical rom-coms.

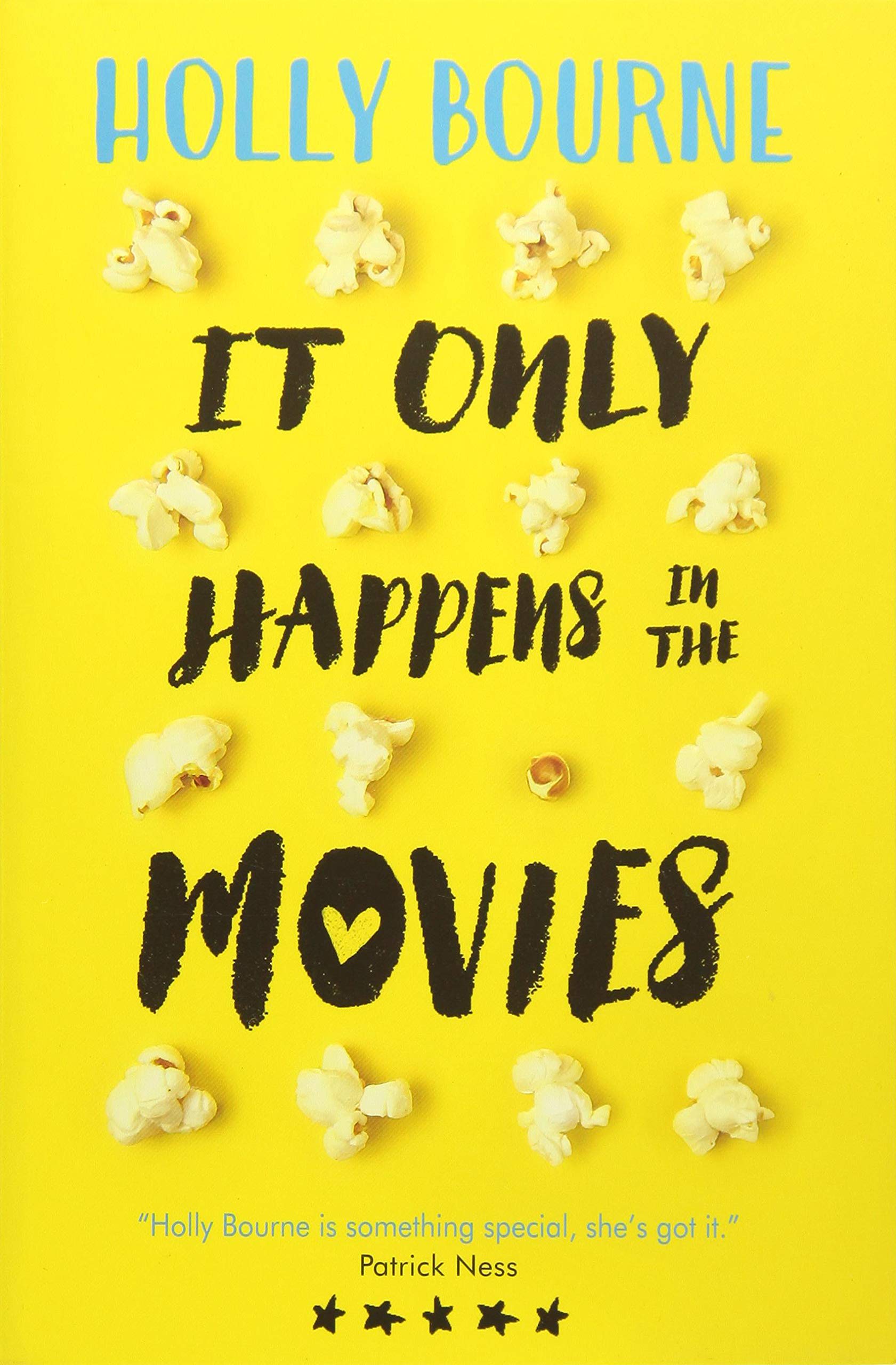

Account icon An icon in the shape of a person's head and shoulders. It Only Happens in the Movies follows Audrey, named after Audrey Hepburn, who is over romance.

0 kommentar(er)

0 kommentar(er)